What does it mean to take a company private?

Private Company accepting a loan from Directors or Relative of Directors Compliances required to be done for accepting the Loan from directors Accepting Loan from Director who is also the Shareholder Circumstances under which the Private company can accept the deposits from members without complying with the provisions of Section 73 (2) Conclusion

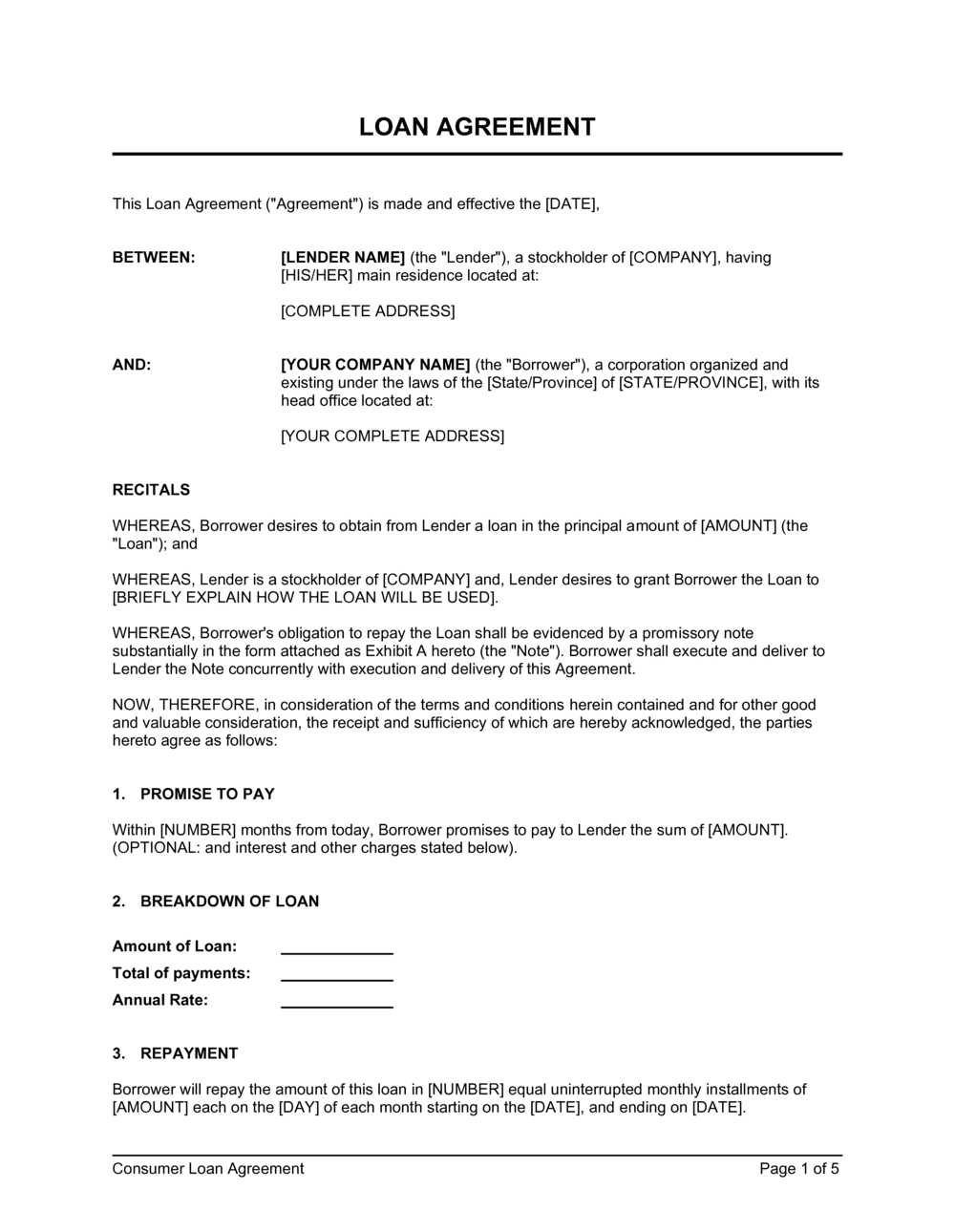

Free Business Loan Agreement Template PDF & Word

a) Make a loan to a director of the company or of a company which by virtue of Section 7 is deemed to be related to that company. b) Enter into any guarantee or provide any security in connection with a loan made to such a director to another person. However, it must be noted that Section 224 does not apply to an exempt private company.

Loan to Director of Company

The term "loan" is not defined under the Companies Act, 2013. In general parlance, a loan means any transaction wherein money is given to returning with or without interest. To meet larger or small financial requirements, companies do approach financial initiations or banks.

Loan Agreement Template Sample Loan money, Loan, Business template

A private company can accept money as a deposit or loan from a director of the company or a relative of the director. However, in such instances, the following conditions shall be met: The Director of the company, during the dispersal of a loan, shall furnish in writing a declaration to the effect that the amount is not being given out of.

Interviewed about a private company paying 25 monthly. This is a part of my cash flow portfolio

Dear Reader, As per Rule 2(1)(c)(viii) of the Companies (Acceptance of Deposits) Rules, 2014, "any amount (loan) received from a director or relative of the director of the private company shall be considered as 'exempt deposit' if such amount is given out of own funds and a declaration affirming the same has been submitted by him"

Managing Director, Private Equity Investments Salary PriceBey

Resolutions eBook. Board Resolution for loan from Director. " RESOLVED THAT pursuant to Section 179 (3) (d) read with the proviso of Rule 2 (1) (c) (viii) of Companies (Acceptance of Deposits) Rules, 2014 and any other applicable provisions of Companies Act, 2013 read with Rules thereunder (including any statutory modifications or re.

Free Loan Contract Template Awesome 40 Free Loan Agreement Templates [word & Pdf] Template Lab

1 comment Loan From Director Or Shareholders In Private Limited And Public Limited Under Companies Act 2013 LOAN FROM DIRECTOR or SHAREHOLDERS UNDER COMPANIES ACT 2013 There is a common question which revolves around is can the director or Shareholder give loan to company? Can it be a private company or unlisted public Company?

Private Company Share Storyboard by isaachin

'Loan to Director' & 'Loan from Director' | Section 179, 180 & 185 Abhishek Wagh | Company Law - Articles | Download PDF 23 Aug 2021 14,811 Views 5 comments Directors of the Company are considered as its trustees.

Sample Money Loan Agreement DocTemplates

Click Now & Choose Your Ideal Company Business Loan Lender. Skip The Bank & Save! Too Many Options For Company Business Loans? We Make Life Easy - See The Best Offers!

Can a company loan to its director? Mar 24, 2022, Johor Bahru (JB), Malaysia, Taman Molek

In terms of provisions of section 185 of the Companies Act, 2013, a company is not allowed to provide any loan (including a loan represented by a book debt) to: its director; or. director of a holding company; or. Any relative or partner of such director; or. Any firm in which such a director or relative is a partner.

Private Student Loan Default [Explained]

The Private Company can avail loan from-. Directors. Shareholder. Relative of Director. Either from their own fund i.e. Directors from its funds, Relative from its funds or Shareholders up to (100% of Paid-up share capital plus free reserves, plus Security Premium Account). Further, the following key features are also taken into consideration.

Director's Loan Account Aardvark Accounting

1. Compliance with director's duties. Directors owe statutory duties to their companies. Directors must therefore make sure that they do not act in breach of these duties when taking/making a director's loan. The duties must be prioritised during every loan transaction.

Director’s loans can you get a loan from your company? • SG Accounting

If Company received loan from a person who is Director as well as shareholder of the Company on the date of acceptance of Loan then whether such loan shall be considered as Loan from Director or Loan from Shareholder totally depend upon the compliances done by the Company for acceptance of such loans.

Interest on Friendly Loan, Director Personally Liable to Debt of Compa

4.Acceptance of Deposit/Loans by Private Company from Director Who is Also A Shareholder: In closely held private companies, usually, the directors and shareholders are same. Considering the compliances and monetary limits, it is desirable that the person discloses the capacity in which the money is given to such companies (i.e. whether the.

Mas Personal Loan The Ultimate Guide Angela Cade

Section 180 of Companies Act, 2013 provides to take prior consent of the members of the company by way of a special resolution to borrow money, where the money to be borrowed, together with the money already borrowed by the company will exceed an aggregate of its paid-up share capital, free reserves, and securities premium, apart from temporary.

Collateral Loan Agreement Template

Updated on: Oct 11th, 2023 | 10 min read CONTENTS [ Show] The Companies Act, 2013 ("Act") regulates the provisions relating to grants of loans to directors of the company. Section 185 of the Act provides the conditions and restrictions of granting loans to the directors.